Meme tokens have been around since the early days of crypto, but lately there’s been a fresh surge—led by community energy, burn mechanics, strategic upgrades, and cross-chain integrations. Two of the front-runners in this wave are Floki (FLOKI) and Baby Doge (BabyDoge). Understanding what’s pushing them—and what could go wrong—offers insight into where the meme coin space may be headed next.

What’s New With Floki & Baby Doge

Floki

- Recently, Floki outperformed many peers. It led meme coin rallies, notably surging ~13% in a particular period, surpassing DOGE, SHIB, and PEPE. CryptoNews+2Coin Edition+2

- Its community has been active: burns, staking utilities, and ecosystem expansion are part of its formula. It’s no longer just “meme energy” — FLOKI is trying to build utility, e.g., DeFi tools, metaverse elements, etc. Reddit+1

Baby Doge

- Baby Doge has upgraded its tech stack: decentralized exchange (DEX) features, dynamic fee structures, concentrated liquidity pools, and gas optimizations are being introduced. CoinMarketCap+1

- Tokens burns and deflationary mechanisms are part of the momentum. With dramatic reductions in circulating supply and increasing community engagement, these factors are driving interest. CryptoNews+1

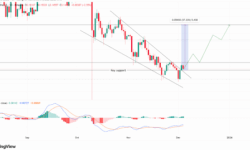

- Also helpful: improvements in trading volume, social following, and technical indicators like RSI and MACD are pointing toward potential breakouts. CryptoNews

Why This New Wave Might Be Different

What distinguishes this newer wave of meme tokens from earlier ones?

- Utility & Ecosystem Building

Whereas early meme tokens were mostly speculative, newer ones are adding real functionality — staking, DEXs, cross-chain features, real-world uses (e.g., payments), and sometimes even gaming/NFT tie-ins. Baby Doge’s DEX upgrades and cross-chain goals are evidence. CoinMarketCap - Deflationary Mechanics

Token burns and decreasing supplies are being used to create scarcity. The idea is: if supply drops, demand or perceived value might increase — though this is never guaranteed. Floki has done burns; Baby Doge is aggressively burning. CryptoNews - Improved Infrastructure

Better DEXs, dynamic fees, liquidity tools, and cross-chain accessibility are helping these tokens move beyond niche speculation. They’re becoming more accessible and efficient. CoinMarketCap - Community & Social Media Momentum

These tokens are thriving in communities — Telegram, X (formerly Twitter), Reddit, etc. Meme coins are uniquely driven by social sentiment, and this wave leans heavily on that. Communities aren’t just watching; many are participating in governance, burns, and “hype engineering.”

Risks to Watch Out For

Even with positive developments, there are important risks that investors and observers should consider:

- Volatility & Speculation Over Fundamentals

Meme tokens tend to swing wildly with sentiment. Chart indicators like RSI or MACD may promise breakouts, but if community or broader market sentiment turns cold, drops can be steep. - Supply Dilution & Inflationary Pressures

Some meme tokens have huge total supplies. Unless burns or tokenomic constraints are solid, inflation undermines potential gains or perceived scarcity. - Security & Rug Risks

Projects depend heavily on smart contract security, audits, trustworthy dev teams. If contracts are flawed or if the team lacks transparency, disasters can happen. - Regulatory & Ethical Risks

Meme tokens with “hype” marketing, celebrity endorsements, or community events can attract regulatory scrutiny, especially if they resemble pump-and-dump schemes or mislead investors. - Competition & Saturation

The meme token space is crowded. As more tokens emerge with similar promises (burn, utility, community), standing out—sustainably—becomes harder.

Rewards & Potential Upsides

On the flip side, in this new meme token wave, the possible gains are still eye-catching, especially for risk-tolerant participants:

- High Return Potential

If a token successfully builds community, utility, and momentum, gains of orders of magnitude are possible. Early entrants have seen large multiples in price during favourable cycles. - Community Ownership & Engagement

Token holders are not just speculators—they often become part of the story: contributing to burns, governance, ecosystem ideas. That gives emotional/investor buy-in, which can help sustain momentum. - Experimentation Ground

Meme tokens are increasingly acting as testbeds: for new tokenomics, gamified finance (gameFi), NFT tie-ins, cross-chain mechanics. Some innovations that work here may influence more “serious” crypto projects. - Liquidity & Exposure

Recent spikes in trading volume, exchange listings, and visibility often bring more eyes, more liquidity, which in turn helps those tokens reach larger audiences and possibly stable growth.

Key Metrics & Signals to Monitor

If you’re following this wave (or considering participation), here are metrics and signals that matter:

| Metric | Why It’s Important |

|---|---|

| Burn Rate / Total Supply Shrinkage | Helps assess if scarcity is being built in. |

| Active Users / Community Engagement | High interaction often precedes surges. |

| Exchange Listings | More exposure & liquidity when on major exchanges. |

| Technical Indicators (RSI, MACD, Volume) | Help identify breakout potential or warning signs. |

| Utility Roadmap | If there are real features (gaming, DEXs, payments), that adds legitimacy. |

| Smart Contract Audits / Security Transparency | To avoid risk of rug pull or exploits. |

What Could Go Wrong

For balance, some scenarios where this wave might underdeliver:

- If sentiment cools, many meme tokens may lack enough utility to hold value.

- If macroeconomic conditions become risk-off (e.g. rising interest rates, regulatory clampdowns), speculative tokens tend to suffer first.

- If there’s a regulatory push against tokens that look like securities, or against unregistered token sales, marketing claims, or influencer promotions, some projects may face legal risk.

- Also, if gas fees (or transaction cost) become too high on their mainnet or bridging costs, the cost of use could negate the benefits for smaller holders.

Final Thoughts: Is This the Next Cycle?

The “new wave” of meme tokens, as represented by Floki, Baby Doge, and their peers, may well be more resilient than past ones because of better infrastructure, clearer tokenomics, and stronger community alignment. But resilience doesn’t guarantee sustainability.

For those watching or participating:

- Treat this as high-risk / high-reward terrain.

- Be realistic about how much of a portfolio you allocate.

- Do your homework: check the roadmap, audit reports, and community legitimacy.

- Stay tuned to both technical signals and social media trends.

If this wave holds up, we might see meme tokens shift from being purely speculative fun to being meaningful (if volatile) components of crypto portfolios—projects that do more than just meme, but deliver some utility and engagement.