Decentralized trading has undergone a seismic shift with the rise of Automated Market Makers (AMMs), a revolutionary mechanism that powers decentralized exchanges (DEXs) without relying on traditional order books or centralized intermediaries. By leveraging smart contracts and liquidity pools, AMMs have become the backbone of DeFi trading, creating seamless, permissionless, and efficient markets for crypto assets.

Understanding Automated Market Makers

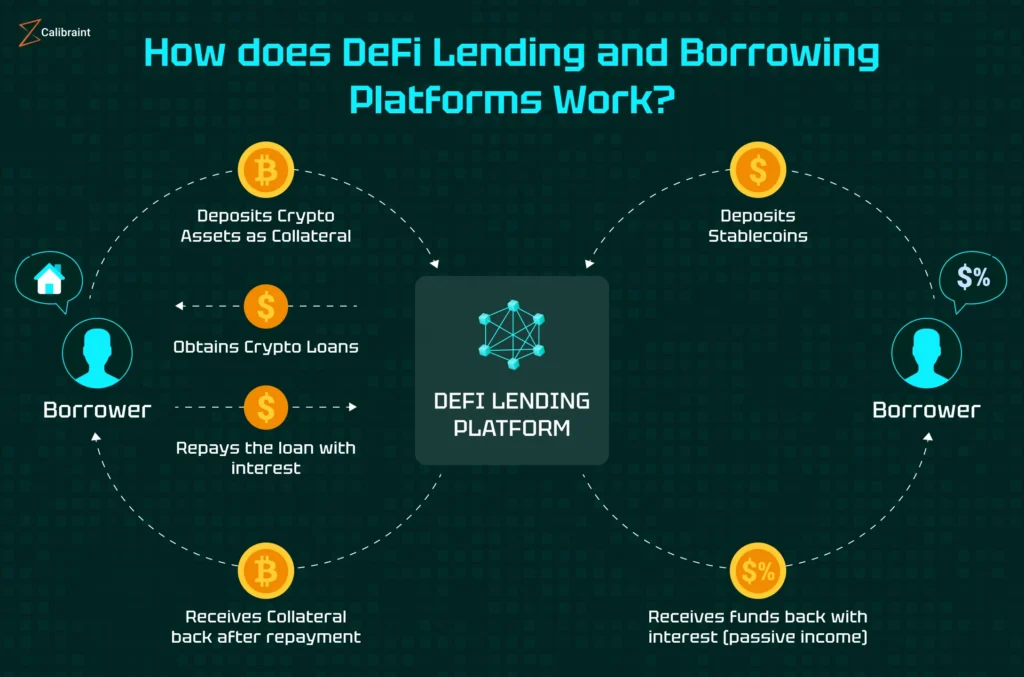

At its core, an AMM is a smart contract-based protocol that facilitates the trading of tokens through liquidity pools rather than matching buyers and sellers directly. These pools are funded by liquidity providers (LPs) who deposit pairs of tokens into the contract. Traders then swap tokens directly with the pool, paying a small fee that is distributed proportionally to the LPs.

Unlike conventional exchanges where market makers adjust prices manually, AMMs rely on algorithmic pricing formulas, such as the constant product formula (x \cdot y = k) popularized by Uniswap. Here, (x) and (y) represent the token reserves, and (k) is a constant. This ensures that the pool’s token ratio automatically adjusts prices based on supply and demand.

The Advantages of AMMs

AMMs have transformed decentralized trading by offering several key benefits:

- Permissionless Access: Anyone can trade or provide liquidity without intermediaries, opening markets globally.

- Continuous Liquidity: Unlike order book exchanges, AMMs always have liquidity available, reducing slippage for smaller trades.

- Incentivized Participation: Liquidity providers earn trading fees proportional to their pool share, creating opportunities for passive income.

- Composable DeFi Ecosystem: AMMs integrate seamlessly with lending protocols, yield farms, and other DeFi applications, enhancing capital efficiency.

Popular AMM Platforms

Uniswap, SushiSwap, Curve, and Balancer are among the most prominent AMM protocols, each offering unique innovations:

- Uniswap: Pioneer of the constant product AMM, emphasizing simplicity and wide token support.

- SushiSwap: Forked from Uniswap with added incentives and governance features.

- Curve: Optimized for stablecoin trading, minimizing slippage and impermanent loss.

- Balancer: Allows multi-token pools and custom weightings, offering flexibility for complex strategies.

These platforms collectively host billions in total value locked (TVL), demonstrating AMMs’ central role in the DeFi landscape.

Risks and Considerations

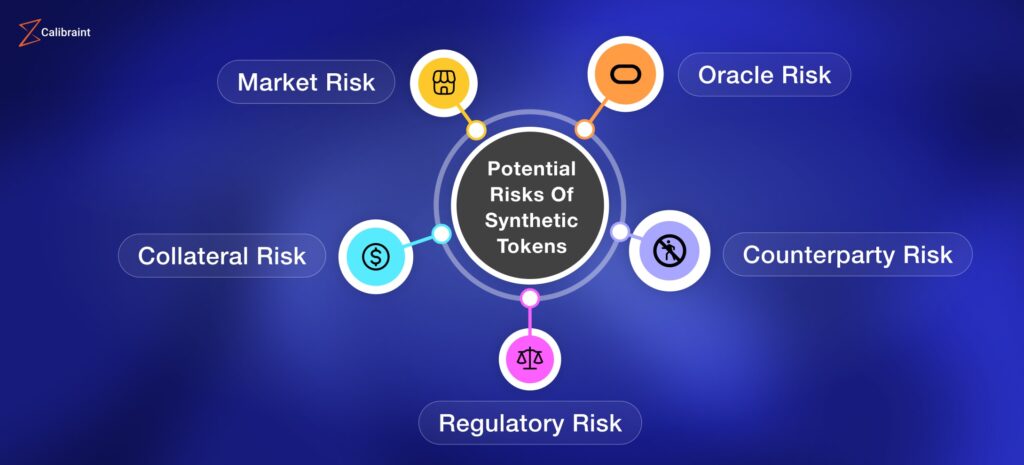

While AMMs democratize trading, they carry inherent risks:

- Impermanent Loss: LPs may experience temporary losses if token ratios change significantly.

- Smart Contract Vulnerabilities: Bugs or exploits can result in loss of funds.

- Slippage and Low Liquidity: Large trades in small pools may incur higher costs due to price impact.

Educated participants mitigate these risks through research, diversified pools, and reputable platforms with robust audits.

The Future of AMMs

AMMs are continuously evolving, with innovations like concentrated liquidity (Uniswap V3), dynamic pricing algorithms, and cross-chain AMMs expanding their efficiency and accessibility. These developments aim to reduce slippage, improve capital utilization, and bridge liquidity across multiple blockchains.

The rise of AMMs signifies a fundamental change in how markets operate. By replacing centralized intermediaries with smart contracts, AMMs have made trading trustless, efficient, and inclusive, laying the groundwork for a truly decentralized financial ecosystem.

Final Thoughts

Automated Market Makers are more than a technical innovation—they are the backbone of decentralized trading. By enabling continuous liquidity, rewarding participants, and powering the broader DeFi ecosystem, AMMs exemplify how blockchain technology can disrupt traditional finance.

In a world increasingly embracing decentralization, AMMs are not just shaping the future of trading—they are defining it.