In the ever-evolving world of finance, few phenomena have captivated global attention quite like Bitcoin. Often hailed as “digital gold,” Bitcoin has grown from a niche experiment in decentralized money to a trillion-dollar market force influencing institutions, governments, and investors alike. But while Bitcoin still dominates headlines, it’s no longer the lone player in the digital asset arena. A broader ecosystem of cryptocurrencies, blockchain projects, and tokenized assets is emerging, reshaping how we think about value, ownership, and the future of money.

So, where does Bitcoin stand today—and what lies beyond it?

Bitcoin: The Bedrock of Digital Assets

Bitcoin continues to be the cornerstone of the cryptocurrency market. With its capped supply of 21 million coins, it has become a hedge against inflation and monetary instability. Institutional adoption is steadily climbing, with companies like MicroStrategy and Tesla holding Bitcoin reserves, while ETFs backed by the asset have brought a wave of mainstream legitimacy.

Yet, Bitcoin’s primary use case—store of value—also highlights its limitations. Unlike more flexible blockchains, Bitcoin’s utility beyond holding or transacting remains limited. Scalability concerns and energy-intensive mining are frequent criticisms. Still, the fact remains: Bitcoin’s security and decentralization are unmatched, making it a trusted anchor in a sea of volatility.

Ethereum and the Rise of Smart Contracts

If Bitcoin is digital gold, Ethereum is the digital oil powering the engines of decentralized finance (DeFi) and Web3 applications. Its smart contract capabilities have unlocked possibilities that Bitcoin simply wasn’t designed to handle—automated lending, decentralized exchanges, NFT marketplaces, and tokenized assets.

Ethereum’s recent upgrades, particularly the transition to proof-of-stake, have not only improved its energy efficiency but also set the stage for greater scalability with technologies like sharding. This positions Ethereum as a hub of innovation that goes beyond monetary transactions, shaping entire industries in digital art, gaming, and even real estate.

Altcoins: Opportunities and Risks

Beyond Bitcoin and Ethereum, thousands of altcoins compete for relevance. Some, like Solana, Avalanche, and Cardano, focus on scalability and faster transaction speeds, attempting to outpace Ethereum. Others, such as Ripple (XRP) and Stellar (XLM), aim to revolutionize cross-border payments. Meme coins like Dogecoin and Shiba Inu, while often dismissed, highlight the power of online communities in driving market dynamics.

But the altcoin space is not without peril. High volatility, regulatory scrutiny, and the constant churn of projects mean investors must tread carefully. For every promising blockchain, dozens of failed or abandoned projects serve as reminders that innovation doesn’t always guarantee survival.

NFTs and the Tokenization of Everything

One of the most exciting developments “beyond Bitcoin” is the rise of non-fungible tokens (NFTs). While once dismissed as overpriced JPEGs, NFTs are evolving into vehicles for digital ownership, identity, and intellectual property. From luxury brands launching digital collections to musicians using NFTs for fan engagement, the applications are expanding.

Moreover, tokenization is reaching beyond art and collectibles. Real estate, stocks, and even carbon credits are being represented on blockchain networks. This “token economy” could transform how assets are bought, sold, and traded globally, with accessibility and transparency at its core.

The Regulatory Crossroads

As digital assets proliferate, global regulators are grappling with how to manage them. The U.S. Securities and Exchange Commission (SEC) has intensified its scrutiny of exchanges and altcoins, while the European Union’s Markets in Crypto-Assets (MiCA) framework aims to bring clarity and consumer protection. Meanwhile, countries like El Salvador have embraced Bitcoin as legal tender, while others remain cautious.

The regulatory landscape will play a pivotal role in shaping the next chapter of digital assets. Striking the right balance between innovation and investor protection will determine how smoothly adoption progresses worldwide.

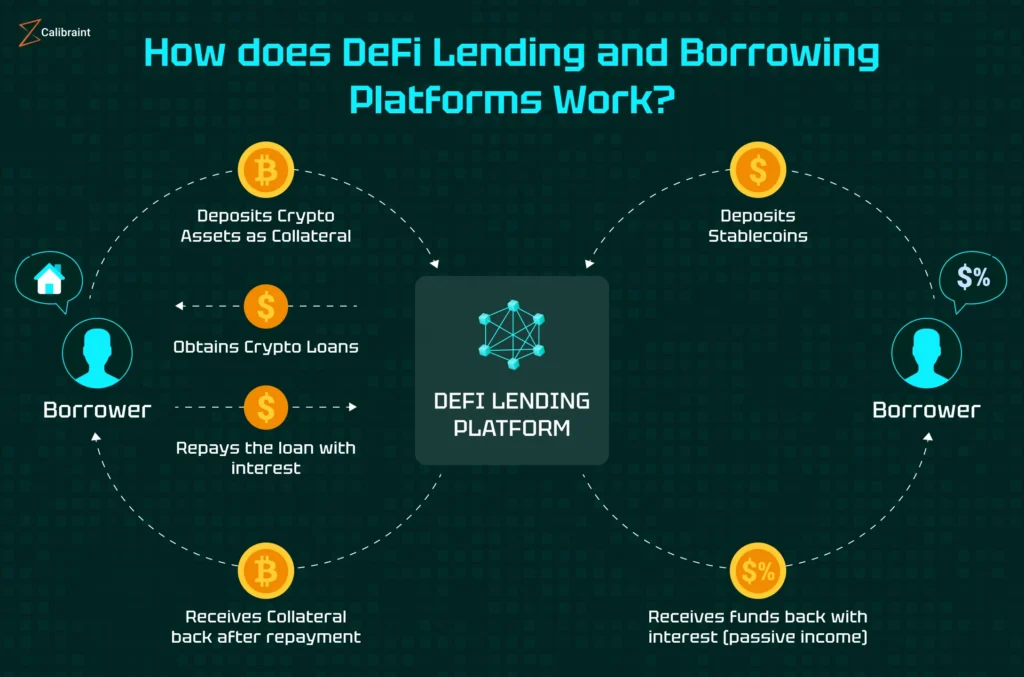

Institutions, DeFi, and the Blurring of Boundaries

Another key trend is the merging of traditional finance (TradFi) and decentralized finance. Wall Street giants are no longer ignoring crypto; instead, they are building services around it. Custody solutions, tokenized ETFs, and blockchain-based settlement systems are bridging the old and new financial worlds.

At the same time, DeFi continues to experiment with governance models, yield farming, and decentralized autonomous organizations (DAOs). While risks remain—such as hacks and rug pulls—the innovation in this space is undeniable.

Looking Ahead: The Future of Digital Assets

The story of digital assets is no longer just about Bitcoin. It’s about an interconnected ecosystem where technology, regulation, and innovation converge. In the coming years, we can expect:

- Wider institutional adoption driving market stability.

- Greater integration of blockchain in supply chains, healthcare, and finance.

- Continued debates around central bank digital currencies (CBDCs).

- The expansion of tokenized real-world assets and cross-chain interoperability.

For investors and observers alike, the lesson is clear: Bitcoin may have lit the spark, but the fire of digital assets is spreading in every direction.

Final Thoughts

Bitcoin’s dominance may still hold, but the digital asset world is far larger than a single cryptocurrency. From Ethereum’s smart contracts to NFTs and tokenized assets, the ecosystem is diversifying at a pace that challenges even seasoned investors to keep up.

For those willing to explore, the opportunities are vast—but so are the risks. As with any frontier market, knowledge, caution, and adaptability are essential. The future of finance is being written in code, and while Bitcoin will always be part of the story, what lies beyond it may be even more transformative.