In an era where trust is being rewritten in lines of code, smart contracts stand at the forefront of blockchain innovation. They’re transforming how agreements are made, verified, and executed — all without intermediaries. From decentralized finance (DeFi) to supply chains and real estate, these digital agreements are redefining efficiency, transparency, and security in the digital economy.

But what exactly are smart contracts, and why are they being hailed as the future of digital transactions?

What Are Smart Contracts?

A smart contract is a self-executing digital agreement where the terms are directly written into code and deployed on a blockchain. When predefined conditions are met, the contract automatically performs the agreed-upon actions — no lawyers, brokers, or middlemen needed.

Think of it as an automated vending machine for agreements:

Insert the right input (data or funds), and the machine dispenses the output (a service, token, or confirmation). No external enforcement or trust is required because the blockchain guarantees execution.

The concept isn’t new — it was first proposed by Nick Szabo in the 1990s — but it took the rise of Ethereum in 2015 to turn theory into practice. Ethereum’s programmable blockchain made it possible for developers to write and deploy smart contracts that now power most of today’s decentralized applications (dApps).

How Smart Contracts Work

At their core, smart contracts operate on a simple “if-then” logic:

- If a condition is met,

- Then execute the corresponding action.

For example:

- If a buyer sends cryptocurrency to an escrow smart contract, then the contract releases ownership of a digital asset to the buyer.

- If an insurance trigger (like a flight delay) is verified via an oracle, then the contract automatically issues a payout.

Once deployed, the contract runs autonomously and immutably, meaning it can’t be changed or tampered with — ensuring that every participant gets exactly what they agreed to.

Why Smart Contracts Matter: The Power of Code-Based Trust

Smart contracts represent a fundamental shift in how we think about trust, business, and value exchange. Their advantages are transforming entire industries:

1. Trustless Automation

Smart contracts eliminate the need for intermediaries. Instead of trusting a company or institution, users trust code and consensus. This drastically reduces human error and potential manipulation.

2. Transparency and Security

All smart contract operations are recorded on a public blockchain. Anyone can audit the code and track transactions, creating unparalleled transparency. Moreover, blockchain’s cryptographic security ensures that data can’t be altered.

3. Cost and Speed Efficiency

Without lawyers, brokers, or administrative overhead, transactions execute almost instantly and at a fraction of the cost.

4. Global Accessibility

Smart contracts can be deployed and executed anywhere in the world — all that’s needed is an internet connection and a crypto wallet.

5. Programmability

Developers can create complex financial ecosystems — like DeFi protocols or NFT marketplaces — by linking multiple smart contracts together, forming powerful decentralized applications.

Real-World Applications of Smart Contracts

Smart contracts are no longer confined to the crypto world. Their utility spans across multiple sectors, each finding unique ways to leverage automation and transparency:

1. Decentralized Finance (DeFi)

DeFi is perhaps the most visible proof of smart contracts in action. Lending, borrowing, trading, and yield farming are all powered by self-executing contracts — removing banks and middlemen from the equation.

2. NFTs and Digital Ownership

NFT marketplaces like OpenSea use smart contracts to verify ownership and handle royalty payments automatically whenever digital assets change hands.

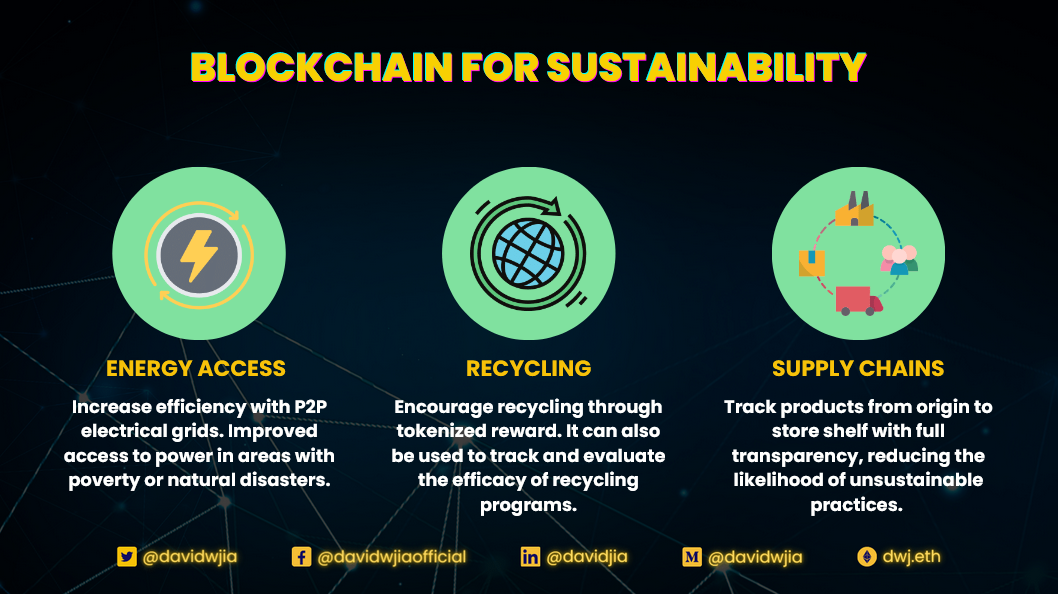

3. Supply Chain Management

Companies use blockchain-based smart contracts to verify authenticity and track goods in real time, reducing fraud and inefficiency in global logistics.

4. Real Estate and Legal Automation

Property transfers, lease agreements, and even wills can be executed through smart contracts — cutting through bureaucracy and ensuring transactions are instant and tamper-proof.

5. Gaming and Metaverse Economies

Smart contracts govern everything from in-game asset ownership to play-to-earn models, creating transparent and player-driven economies in virtual spaces.

The Role of Oracles: Bringing Off-Chain Data On-Chain

While smart contracts can execute flawlessly on blockchain data, many real-world conditions (like weather, stock prices, or delivery confirmations) exist off-chain.

That’s where oracles come in — decentralized data feeds that connect blockchains to external information sources. Protocols like Chainlink ensure that smart contracts receive reliable and tamper-proof real-world data, expanding their capabilities beyond closed systems.

Without oracles, smart contracts would be like powerful machines without sensors — efficient but blind to the world outside their chain.

Challenges and Limitations

Despite their promise, smart contracts face several challenges before reaching mainstream adoption:

- Security Risks: Bugs or vulnerabilities in code can lead to massive losses, as seen in several DeFi hacks.

- Lack of Standardization: Different blockchain networks have different programming environments, complicating interoperability.

- Legal Recognition: While smart contracts can enforce digital terms, they often lack legal clarity in traditional jurisdictions.

- Scalability: Executing complex contracts consumes significant computational power and can lead to network congestion.

To overcome these barriers, developers are focusing on formal verification, better testing tools, and cross-chain compatibility.

The Future: Code as Law

The trajectory of smart contracts points toward a future where code enforces law, not just facilitates it. As interoperability improves and regulations catch up, smart contracts could underpin entire systems — from global finance to governance and identity.

Imagine a world where you buy a house, sign an employment contract, or receive healthcare benefits — all handled instantly and transparently by code. This isn’t sci-fi; it’s the emerging digital infrastructure of Web3.

Final Thoughts

Smart contracts are more than a blockchain feature — they’re the heartbeat of decentralization. They redefine trust, reduce friction, and make agreements programmable. While challenges remain, their evolution is inevitable, pushing us closer to a future where the economy runs on open, self-executing code.

In essence, smart contracts are not just digital agreements — they’re the digital revolution in motion.