Meme coins have taken the cryptocurrency world by storm, blending internet culture, viral trends, and speculative trading into a highly volatile market. While these tokens can deliver astronomical gains in short periods, they also pose significant risks. Successful trading requires more than luck—it demands a deep understanding of timing, risk management, and community dynamics that drive these unique assets.

Understanding Meme Coin Dynamics

Meme coins differ fundamentally from traditional cryptocurrencies like Bitcoin or Ethereum. Their value is largely influenced by:

- Social Media Trends: Platforms like Twitter, Reddit, and TikTok can trigger sudden surges in demand.

- Celebrity Endorsements: Influencers or high-profile figures can drive massive hype, impacting prices instantly.

- Community Activity: Active and engaged communities are essential for sustaining interest and momentum.

- Market Sentiment: Fear of missing out (FOMO) and viral popularity often dictate price swings more than fundamentals.

Recognizing these factors is critical for timing trades and anticipating market movements.

Timing Strategies

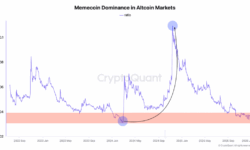

Timing is paramount in meme coin trading due to extreme volatility:

- Trend Following: Monitor social media, Reddit threads, and Twitter feeds for emerging coins gaining traction. Early entry can maximize upside.

- Momentum Trading: Take advantage of rapid price increases triggered by hype or news. Exiting positions before sentiment fades is essential to lock in gains.

- Breakout Trading: Identify support and resistance levels in price charts. Meme coins often experience sharp breakouts when certain price thresholds or community milestones are achieved.

- Event-Based Timing: Launches, airdrops, or celebrity endorsements often create spikes in interest. Aligning trades with such events can enhance profitability.

Successful timing requires constant monitoring and fast decision-making, as meme coin trends can reverse in minutes.

Risk Management Techniques

Given their volatility, effective risk management is crucial:

- Set Clear Limits: Allocate only a small portion of your portfolio to meme coins, avoiding exposure to funds you cannot afford to lose.

- Stop-Loss Orders: Automate exits to prevent catastrophic losses if a trend reverses suddenly.

- Diversification: Spread investments across multiple meme coins to mitigate single-asset risk.

- Take Profits Strategically: Lock in gains incrementally rather than chasing maximum possible profits, as prices often correct sharply.

Discipline and planning are essential to survive and thrive in a market defined by rapid sentiment swings.

Leveraging Community Insights

Meme coin success is often community-driven, making social intelligence a powerful trading tool:

- Monitor Online Forums: Subreddits, Discord channels, and Telegram groups provide early indicators of community interest and potential price movement.

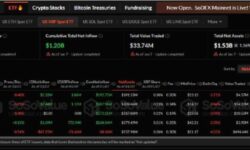

- Sentiment Analysis: Tools like LunarCrush and The TIE track social engagement and sentiment, offering quantitative insights into hype cycles.

- Influencer Signals: Tweets or public statements from high-profile figures can dramatically affect trading behavior. Recognizing patterns and timing entries around these signals is critical.

- Network Activity: On-chain data, including wallet activity, token holdings, and transaction spikes, provides clues about buying and selling pressure.

In meme coin trading, community sentiment often trumps technical fundamentals, making engagement and analysis of social dynamics essential.

Technical and Charting Tools

Even in hype-driven markets, technical analysis can improve timing and strategy:

- Support and Resistance Levels: Identify key price points where buying or selling pressure is likely.

- Volume Analysis: Sudden surges in trade volume often precede major price movements.

- Moving Averages: Short-term averages can highlight momentum shifts in highly volatile coins.

- Candlestick Patterns: Recognize reversal or continuation patterns to time entries and exits effectively.

Combining social insights with technical indicators provides a more balanced approach to meme coin trading.

Avoiding Common Pitfalls

Meme coin trading is risky, and even experienced traders can fall into traps:

- Chasing Hype: Entering after a coin has already surged often results in losses when the hype fades.

- Ignoring Fundamentals: While meme coins are speculative, some tokenomics factors—supply, burn rates, and liquidity—still matter.

- Emotional Trading: FOMO and fear can override rational decision-making, leading to impulsive losses.

- Lack of Exit Strategy: Not having pre-defined profit-taking or stop-loss plans can amplify risks.

Awareness and preparation are key to avoiding these pitfalls.

Combining Strategies for Success

A comprehensive approach to meme coin trading integrates:

- Early Identification: Spot emerging trends through social and online monitoring.

- Technical Analysis: Use charts and volume data to optimize entry and exit points.

- Risk Management: Define limits, set stop-losses, and take profits strategically.

- Community Engagement: Track sentiment, influencer activity, and on-chain metrics to anticipate movements.

This multifaceted strategy allows traders to capitalize on short-term opportunities while mitigating catastrophic losses.

Final Thoughts

Meme coin trading is a high-stakes, high-reward segment of the cryptocurrency market. While the allure of massive gains attracts speculative investors, the extreme volatility and hype-driven dynamics make discipline, strategy, and social awareness essential.

By understanding timing, risk, and community insights, traders can navigate meme coins with a structured approach, balancing the thrill of viral trends with the necessity of prudent financial management. In a world where a single tweet can move markets, knowledge and preparation are the trader’s greatest allies.