- Dormant Bitcoin supply fears reshape price outlook as markets reprice future circulation risk from old wallets.

- Active Bitcoin supply stagnation shows falling engagement and growing emotional fatigue among investors.

- Short-term holders face historic losses while large redistribution avoids a full structural market crash.

Bitcoin is having a rough stretch. Since Q4 2025, BTC has underperformed every major asset class. Analysts are now pointing to two key concerns driving that lag: quantum computing risks and dormant coin supply.

Meanwhile, at press time, CoinGecko price data shows Bitcoin trading at $66,828.19, down 2.04% over the last 24 hours. The sell-off has many asking what is really weighing on the market.

Millions of Lost Bitcoin Are Back in the Conversation

Analyst Ash Crypto recently flagged a concern that markets are quietly pricing in.

Roughly 3.5 to 4 million BTC mined in Bitcoin’s early years are considered lost or permanently dormant today. That figure represents nearly 18% of Bitcoin’s total supply. The keyword, though, is “considered.”

🚨ANOTHER REASON WHY BITCOIN IS DUMPING NON STOP.

Since Q4 2025, BTC has underperformed every major asset class. This has a lot to do with quantum computing concerns and lost coins.

Roughly 3.5–4 million BTC mined in Bitcoin’s early years are considered lost or permanently… pic.twitter.com/wVRLzl9HYG

— Ash Crypto (@AshCrypto) February 18, 2026

With quantum computing advancing, older wallets are getting fresh attention. Many early wallets have exposed public keys, making them a theoretical target. If even a portion of that dormant supply returned to circulation, forward supply expectations would shift.

Ash Crypto noted that markets may already be discounting that risk today, which puts downward pressure on price.

Institutional Accumulation Has Not Been Enough

Here is where the numbers get interesting. Since 2020, institutions, ETFs, and corporates have accumulated between 2.5 and 3 million BTC. That range sits right alongside the dormant supply figure. Institutions have absorbed a massive amount of supply. Yet the overhang concern still lingers.

Ash Crypto pointed out that 13 to 14 million BTC have already moved during this cycle. That is the largest on-chain redistribution ever recorded.

Despite that enormous sell-side liquidity, Bitcoin did not crash structurally. So the market may be overreacting to a theoretical future supply shock that may never actually materialize.

On-Chain Activity Is Slowing Down Fast

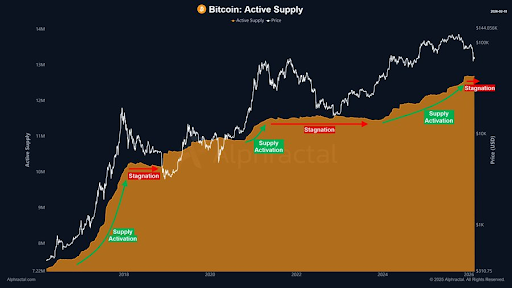

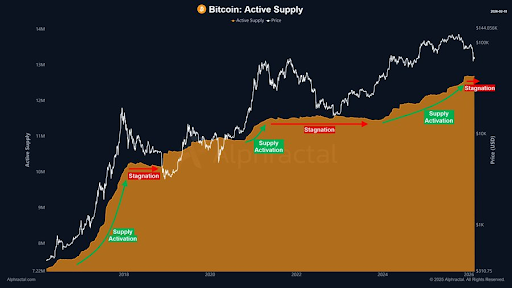

The supply concern is not the only signal worth watching. Alphractal, a crypto analytics account, noted that Bitcoin’s active supply has stopped growing. Fewer coins are moving. Network activity has slowed noticeably.

Alphractal described it as social demotivation reflected on-chain. Holders are not moving coins. Participants are stepping back. The network is getting quieter.

According to Alphractal, behavior shifts before narratives do. That silence on-chain may be an early sign of deeper emotional fatigue across the market.

Short-Term Holders Are Sitting on Heavy Losses

On-chain analyst account OnChainMind added another layer to the picture.

Short-term holders, those who have held Bitcoin for less than five months, are sitting on deep unrealized losses. New investor profitability is near some of the lowest levels in Bitcoin’s history.

OnChainMind noted that pain is high and capitulation could still come. Still, the analyst views this as a long-term accumulation opportunity rather than a reason to exit.

The Bitcoin market is under serious pressure.

Short-term holders (<5 months) are in deep unrealised losses, with new investor profitability at some of the lowest levels of its entire history.

Pain is high, capitulation may come, but this is also where my long-term… pic.twitter.com/LYmtnsRdh5

— On-Chain Mind (@OnChainMind) February 18, 2026

The broader takeaway across all three analysts is the same. Bitcoin is navigating a tricky moment where theoretical risks, weak sentiment, and holder losses are all compressing price at the same time.

The post Why Bitcoin Is Lagging as Markets Reprice Dormant Supply Risk appeared first on Live Bitcoin News.